Lhdn Borang B Tax Rate

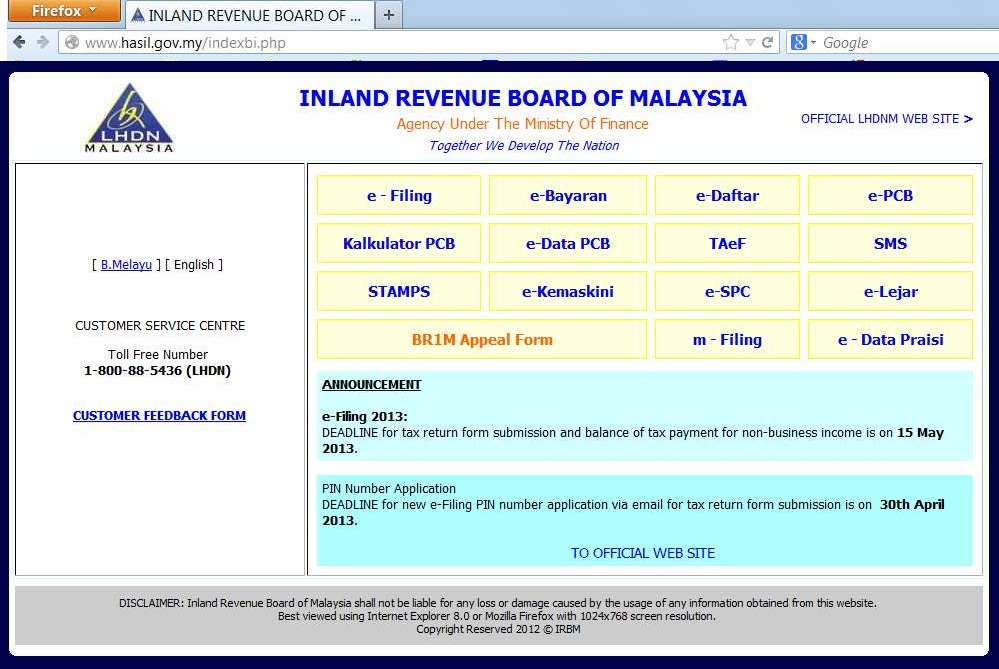

Pembayar cukai boleh mengemukakan memfailkan borang nyata cukai pendapatan bncp secara online melalui e filing atau secara manual.

Lhdn borang b tax rate. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. All records working sheets and documents need not be enclosed when submitting the form b except for the purpose of tax refund in which case the following working sheet s is are required to be submitted. Apa beza borang be dan borang b. There are 21 tax reliefs available for individual taxpayers to claim.

What is income tax return. Tis the season to file your taxes again so we thought we d help. What is tax rebate. Borang be 2019 borang b 2019 borang be 2018 borang b 2018.

10 membayar cukai pendapatan yang sepatutnya boleh mengelakkan anda dari dikenakan kenaikan cukai tindakan mahkamah serta sekatan perjalanan keluar negara. Malaysia income tax e filing. If you re a sole prop or business owner here s why you should. Tax reliefs and rebates.

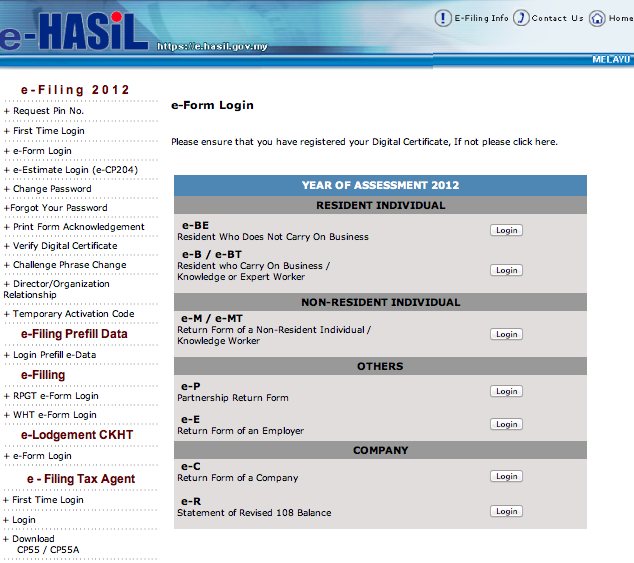

Corporate income tax or corporate tax is a direct tax that is paid to the government via irbm lhdn it is governed under the income tax act 1967. Sebenarnya borang be b 2020 akan dimuat naik pada 1 mac. Prepare malaysian income tax returns by sya147. Cukai pendapatan kesejahteraan cukai anda bermula di sini.

151 2012 on the returning expert programme at the official portal of lembaga hasil dalam negeri malaysia lhdnm. What is a tax deduction. Borang be untuk individu. Solved finance question chegg com.

You just need to be aware of these reliefs and make a point of keeping the receipts when you expend money in these areas. Borang b tax here s a how to guide file your income tax online lhdn in malaysia. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Anda nak tengok borang be b 2020.

Additionally the tax rate on those earning more than rm2 million per year has been increased from 28 to 30. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. How does monthly tax deduction mtd pcb work in malaysia. A corporate tax rate of 17 to 24 is imposed upon resident and non resident companies on taxable income that is sourced from or obtained in malaysia.

150 tarikh kemaskini. Tax relief for year of assessment 2019 tax filed in 2020 chapter 5.