Borang Be Malaysia

Failure to do so will result in the irb taking legal action against the company s director.

Borang be malaysia. E permohonan pindaan be adalah permohonan pindaan atas kesilapan atau khilaf bagi borang nyata cukai pendapatan yang telah dikemukakan secara e filing atau m filing dalam tempoh semakan pengesahan semakan semula pengesahan penerimaan borang yang telah dihantar secara e filing. Posts about borang be written by fm. Our address is. V applicant who do not have borang w must produce 2 photocopies of parent s document.

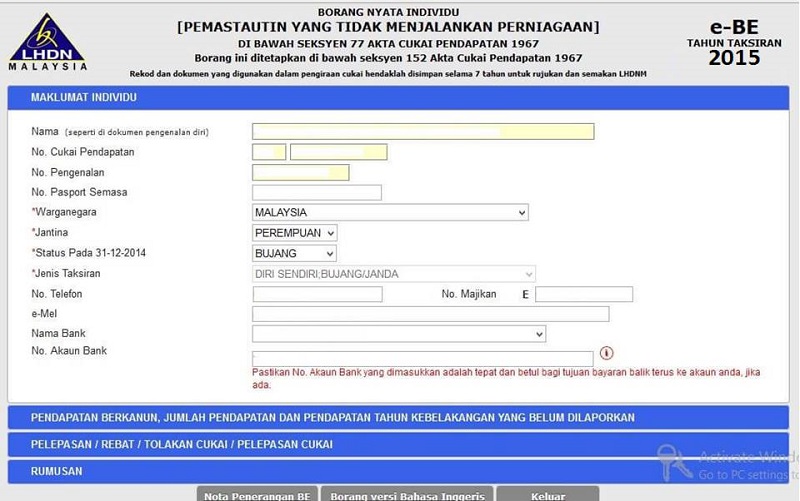

Registration of malaysians form. Lembaga hasil dalam negeri malaysia borang nyata individu pemastautin yang tidak menjalankan perniagaan di bawah seksyen 77 akta cukai pendapatan 1967 borang ini ditetapkan di bawah seksyen 152 akta cukai pendapatan 1967 be 2019 tahun taksiran borang cp4b pin. Individual income tax lhdn malaysia. Approved akuan pelepashakan kewarganegaraan malaysia.

Identity card birth certificate citizenship certificate and passport. Last updated by nur ashikin binti ali. Borang k pdf version 1 0 uploaded by nur ashikin binti ali 5 20 10 2 23 am akuan pelepashakan kewarganegaraan malaysia tags. Kindly note that minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e and cp8d to irb as well as prepare and deliver form ea to the employees.

Lembaga hasil dalam negeri malaysia borang nyata individu pemastautin yang tidak menjalankan perniagaan di bawah seksyen 77 akta cukai pendapatan 1967 borang ini ditetapkan di bawah seksyen 152 akta cukai pendapatan 1967 be 2018 tahun taksiran borang cp4b pin. E filing adalah platform lembaga hasil dalam negeri lhdn untuk memudahkan individu syarikat di malaysia menguruskan cukai pendapatan dan syarikat. Malaysia yang dikenakan cukai di malaysia dan juga di luar malaysia. Pembayar cukai dinasihatkan untuk menggunakan pengesahan penerimaan borang nyata cukai pendapatan sebagai pengesahan status seseorang yang dikenakan cukai di malaysia.

Program memfail borang nyata bn bagi tahun 2020 pindaan 1 2020 program memfail borang nyata bn bagi tahun 2020 pindaan 2 2020. Rujuk lampiran f buku panduan borang be untuk menentukan negaranegara yang membuat perjanjian pengelakan percukaian dua kali dengan malaysia. Pengesahan ini boleh didapati melalui perkhidmatan ezhasil di https ez hasil gov my atau di cawangan cawangan lhdnm. Pengiraan boleh dibuat di hk 8 buku panduan borang be.

Vi collection of the acknowledgement slip is after three 3 working days. Potongan cukai adalah berbeza bagi setiap individu mengikut pendapatan tahunan masing masing. Ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor.