Lhdn Borang B 2019 Deadline

B 2019 resident individual who carries on business 30 june 2020.

Lhdn borang b 2019 deadline. Lembaga hasil dalam negeri malaysia bahagian pengurusan rekod maklumat percukaian jabatan operasi cukai menara hasil no. Tarikh akhir e filling 2020 lhdn perhatian buat pembayar cukai bila tarikh akhir hantar borang cukai efilling 2020 untuk tahun taksiran 2019. 8 untuk maklumat lanjut sila hubungi hasil care line talian hotline. You can file your taxes on ezhasil on the lhdn website.

Thus the new deadline for filing your income tax returns in malaysia via e filing is 30 june 2020 for resident individuals who do not carry on a business and 30 august 2020 for resident individuals who carry on a. 3 jalan 9 10 seksyen 9 karung berkunci 221. Grace period is given until 6 january 2020. Untuk makluman pengemukaan borang nyata cukai pendapatan bncp lembaga hasil dalam negeri malaysia untuk tahun taksiran 2019melalui e filling bagi borang e be b bt p mt dan tf boleh dilakukan pada tarikh yang dinyatakan dibawah.

Tax filing deadline extension for year 2020 updated 28 april 2020. How to file your personal income tax online in malaysia. Bncp dan borang anggaran yang disediakan dalam e filing adalah seperti berikut. 03 89111000 603 89111100 luar negara 2019 tahunborang taksiran cp4a pin.

Gone are the days of queuing up in the wee hours of the morning at the tax office to complete your filing. Deadline extended deadline by e filing a. The accounting period of a real estate investment trust reit ends on 31 may 2019. Income tax deadline 2019.

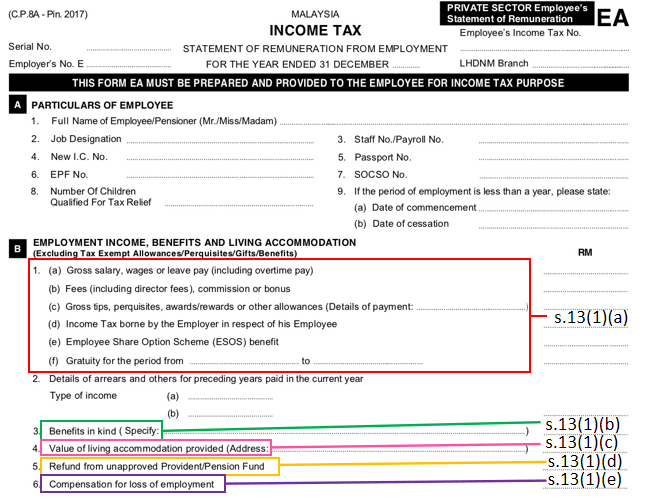

7 penggunaan e filing e b adalah digalakkan. Meanwhile for the b form resident individuals who carry on business the deadline is 15 july for e filing and 30 june for manual filing. The due date for submission of the reit s rf form tr for year of assessment 2019 is 31 december 2019. Borang b bt e b e bt ada punca pendapatan perniagaan pekerja berpengetahuan atau berkepakaran.

According to lembaga hasil dalam negeri lhdn the move is meant to facilitate the submission of tax returns affected by the national movement control order which starts today. E 2018 employer 31 march 2019 be 2018 resident individual who does not carry on any business 30 april 2019 b 2018 resident individual who carries on business 30 june 2019 p 2018 partnership bt 2018 resident individual knowledge worker expert worker 30 april 2019 does not carry on any business 30 june 2019 carries on business m 2018. Employers form e employers ya 2019 31 march 2020 31 may 2020 b. For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing.

Individuals partnerships form be resident individuals who do not carry on business ya 2019 30 april 2020 30 june 2020.