Income Tax Borang E 2019

Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file.

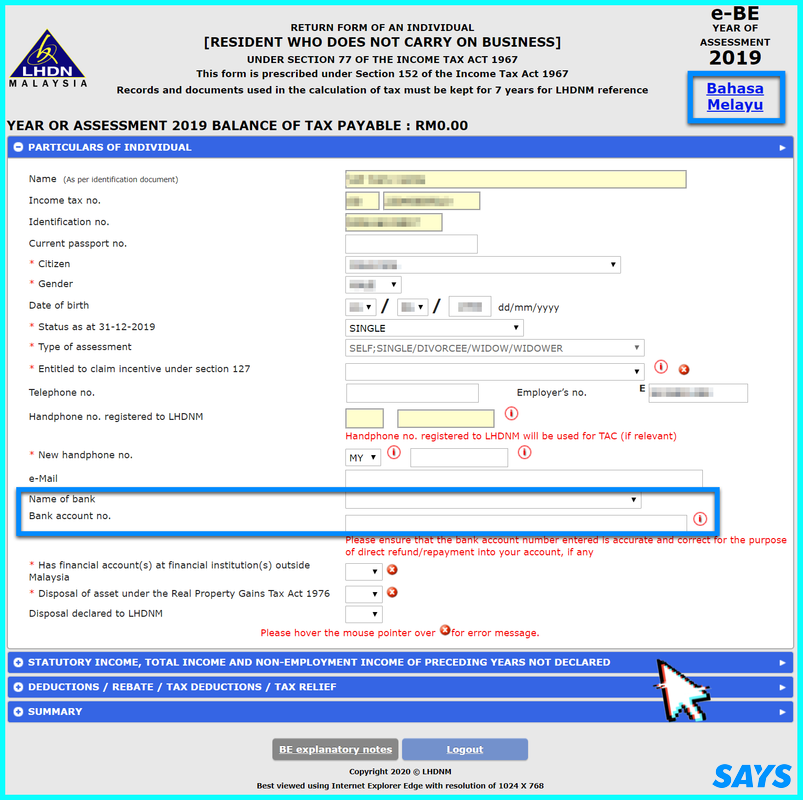

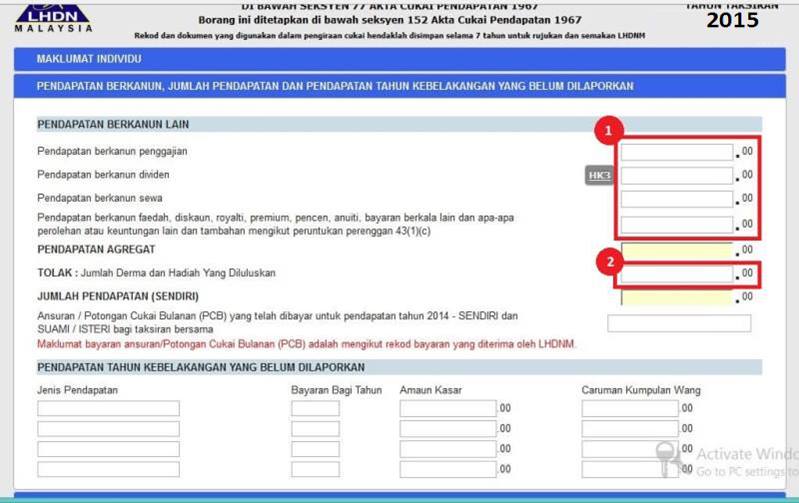

Income tax borang e 2019. Sekiranya anda memasukkan no. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Income tax act 1967. This is to maintain parity between the tax rates of non resident individuals and the top marginal tax rate of resident individuals.

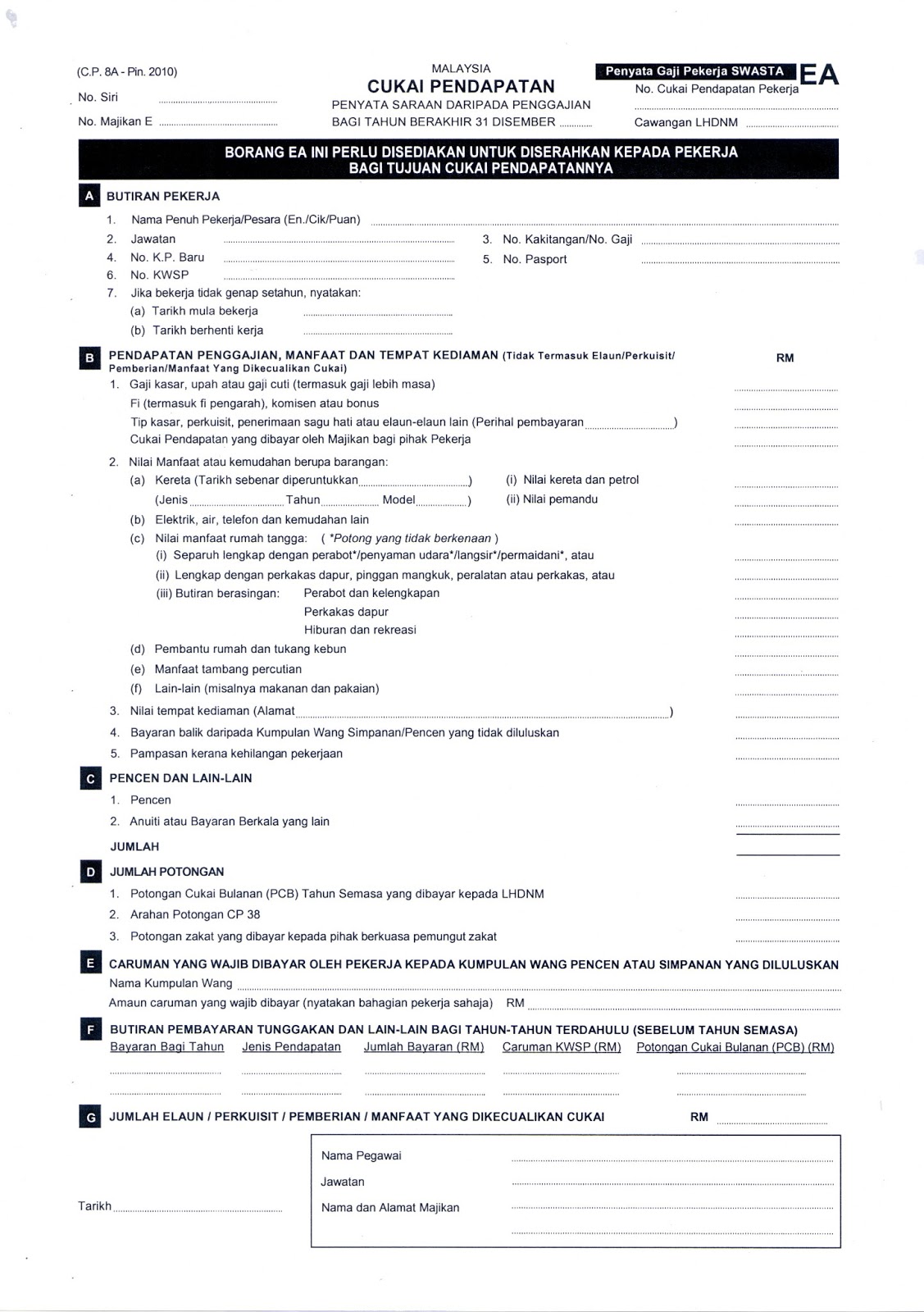

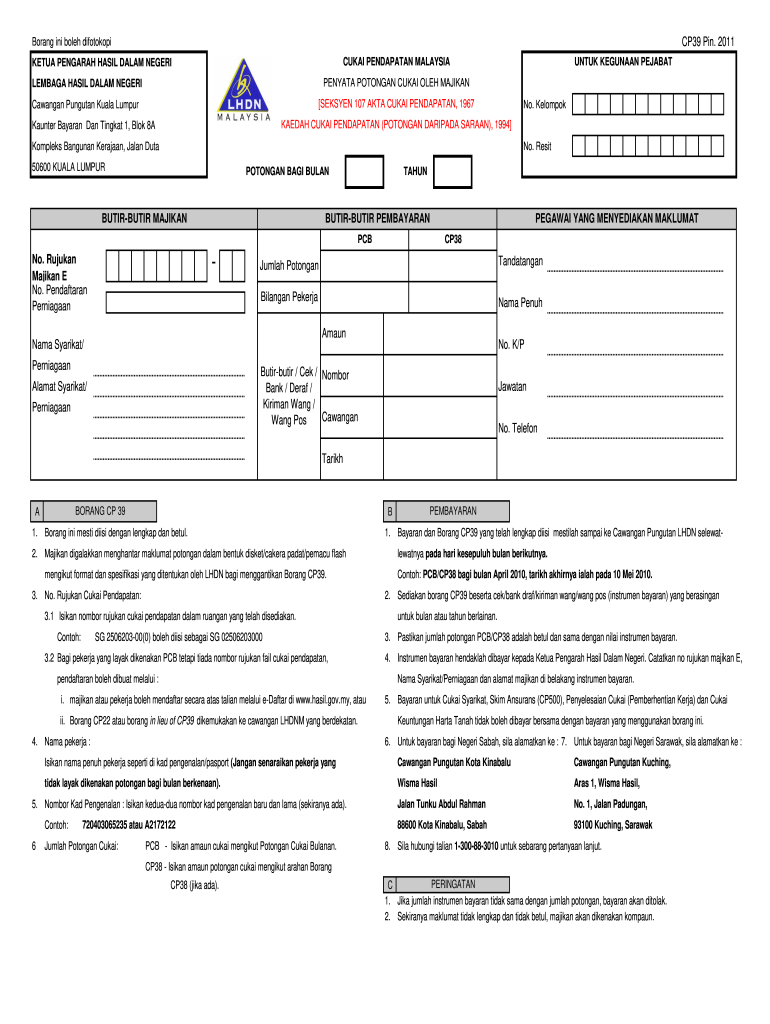

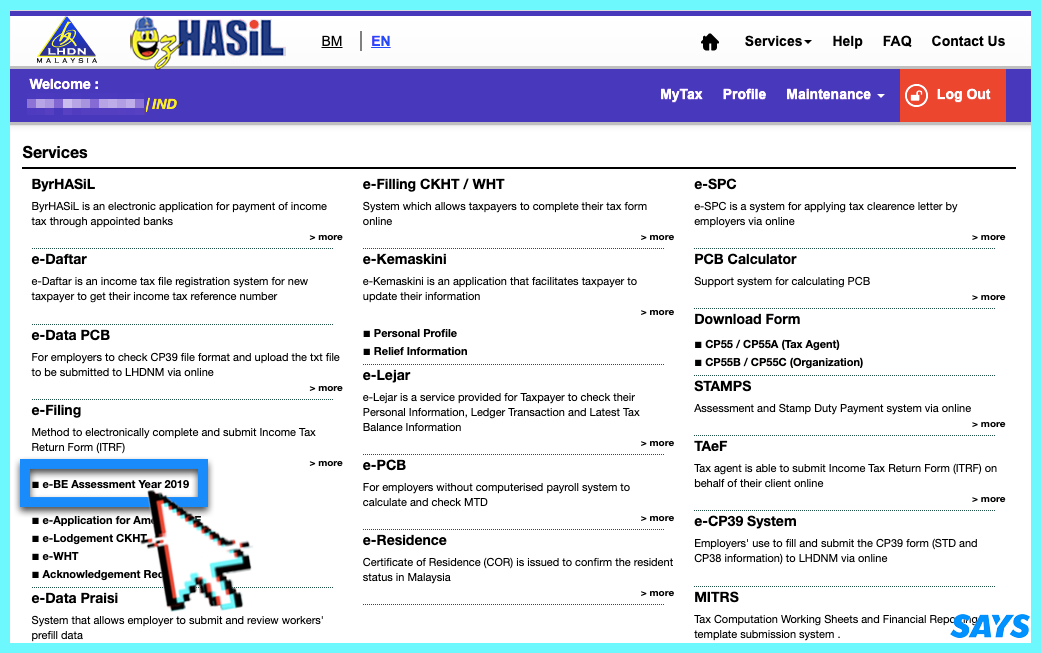

Bahawa pembayar cukai yang pertama kali melaporkan pendapatan menyamai atau melebihi rm 450 000 melalui hantaran borang secara e filing perlu memohon tac. Registering as a first time taxpayer on e daftar. Program memfail borang nyata bn bagi tahun 2019 pindaan 4 2019 contoh format baucar dividen. Form e borang e is required to be submitted by every employer company.

The deadline for filing income tax in malaysia is 30 april 2019 for manual filing and 15 may 2019 via e filing. From ya 2017 the tax rates for non resident individuals except certain reduced final withholding tax rates has been raised from 20 to 22. Carian maklumat tarikh penghantaran borang cukai pendapatan secara manual dan efiling untuk tahun taksiran 2019 beserta tambahan masa. Tarikh akhir penghantaran borang cukai e filing 2020 taksiran tahun 2019.

Mulai 18 mac 2019. 31 ogos 2020 ialah tarikh akhir penghantaran borang b tahun taksiran 2019 dan pembayaran cukai pendapatan bagi individu yang memperolehi pendapatan perniagaan. Pasport baru dan pernah menggunakan e filing. You can file your taxes on ezhasil on the lhdn website.

E permohonan pindaan be adalah permohonan pindaan atas kesilapan atau khilaf bagi borang nyata cukai pendapatan yang telah dikemukakan secara e filing atau m filing dalam tempoh semakan pengesahan semakan semula pengesahan penerimaan borang yang telah dihantar secara e filing. Program memfail borang nyata bn bagi tahun 2020 pindaan 3 2020 muat turun borang. Taxes on director s fee consultation fees and all other income. Tax administration diagnostic assessment tool tadat.

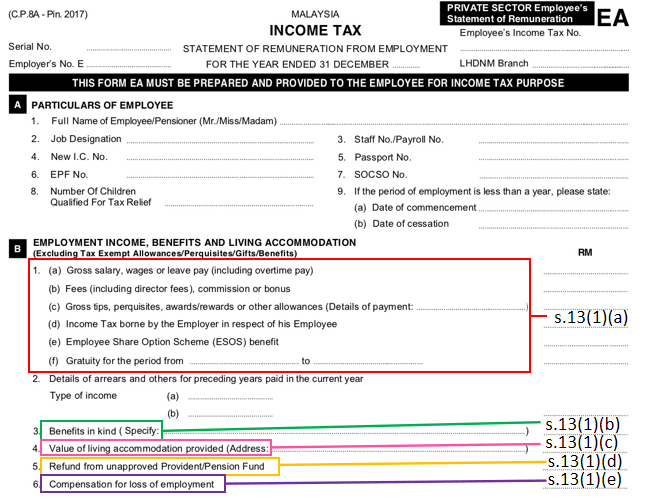

Untuk makluman pengemukaan borang nyata cukai pendapatan bncp lembaga hasil dalam negeri malaysia untuk tahun taksiran 2019melalui e filling bagi borang e be b bt p mt dan tf boleh dilakukan pada tarikh yang dinyatakan dibawah. Details for all employees remuneration matters to be included in the cp8d 2019 c p 8d has 18 columns to be filled up per employee basis which requires extensive information and the coverage of.