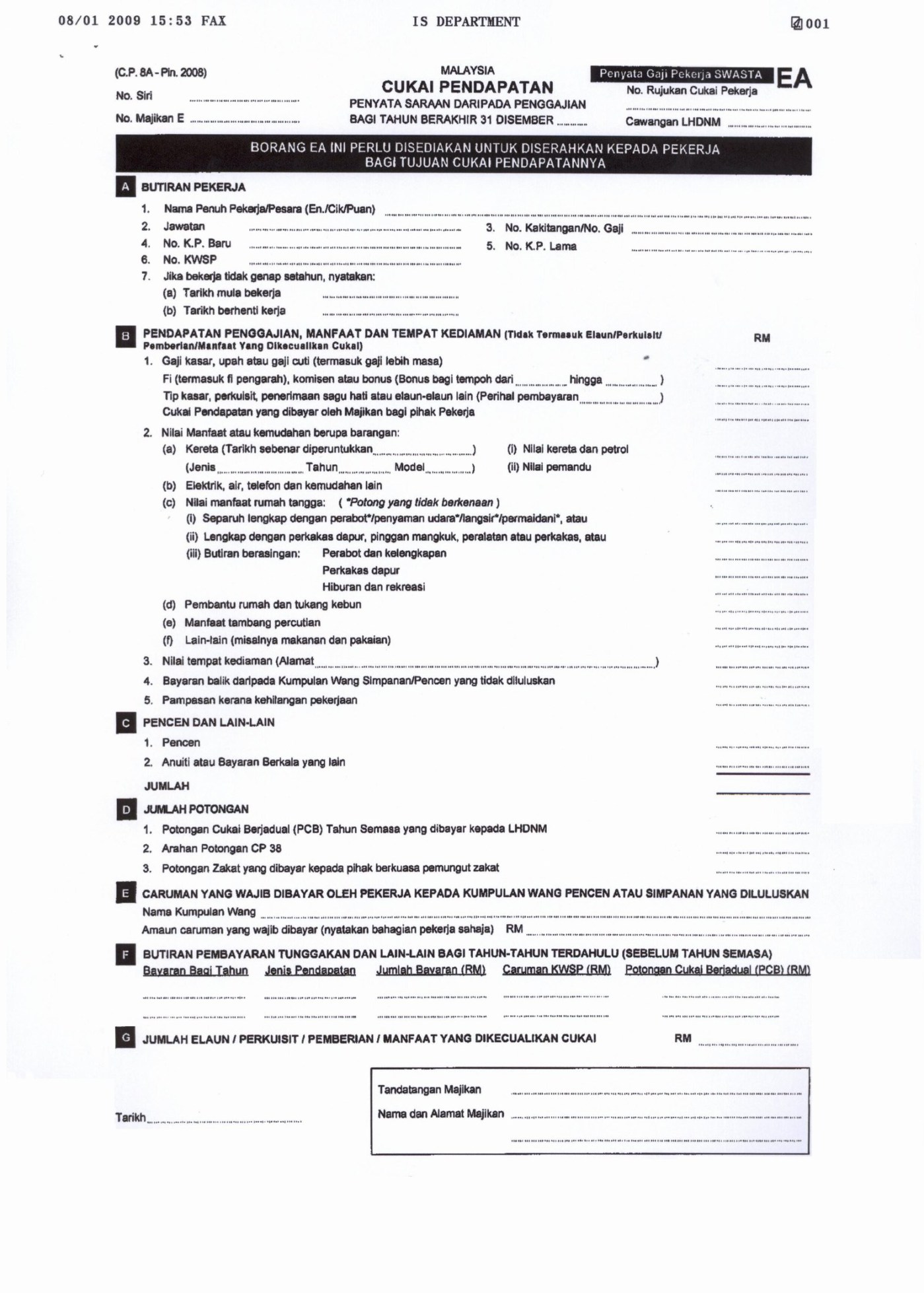

Borang Ea Section F

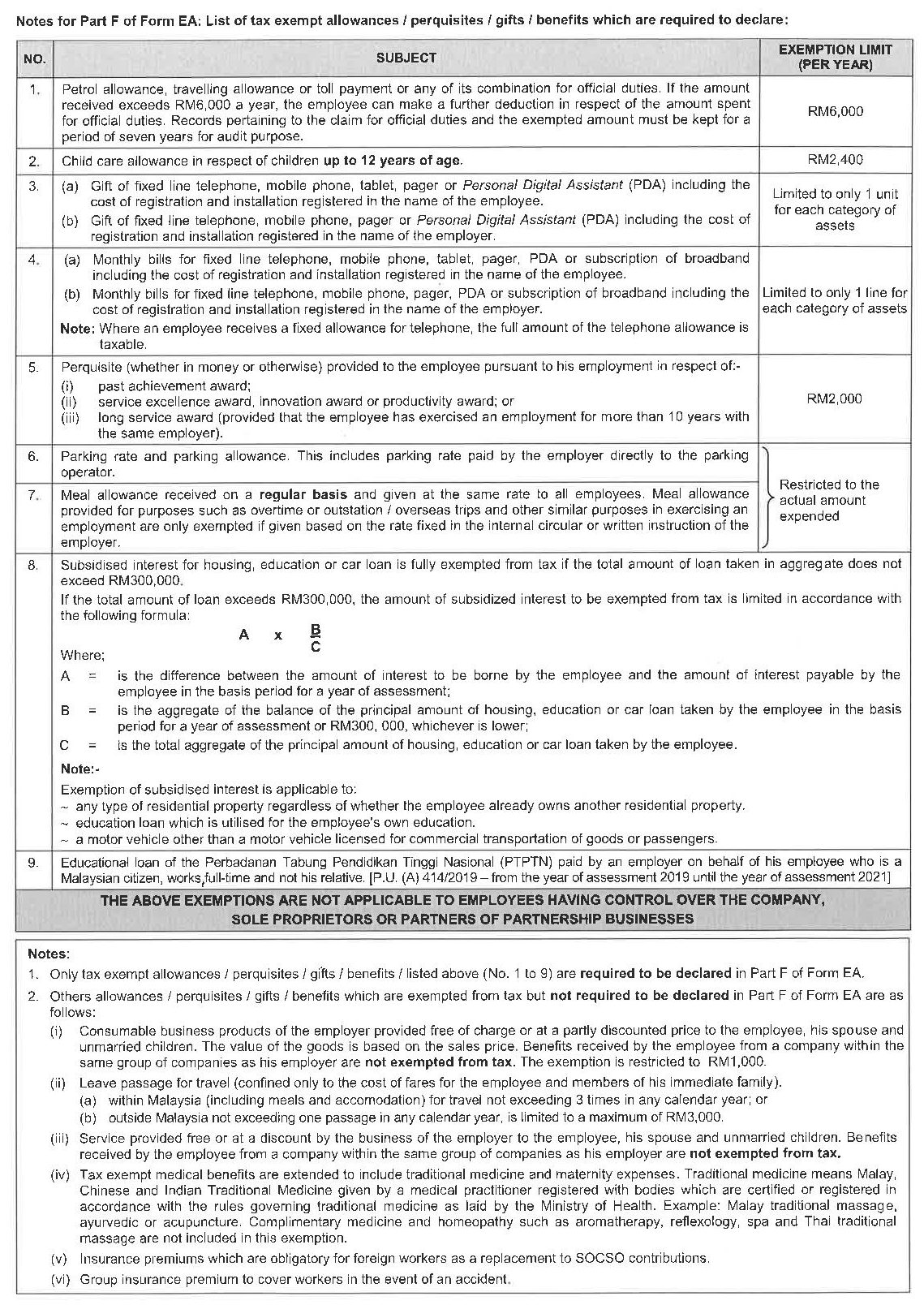

1 to 8 are required to declare in part f of form ea.

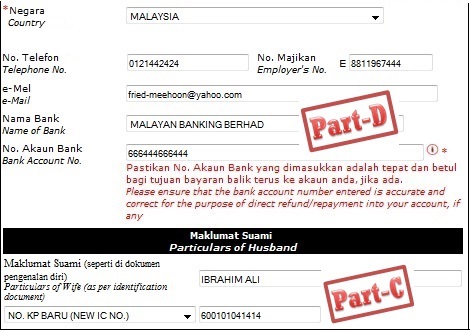

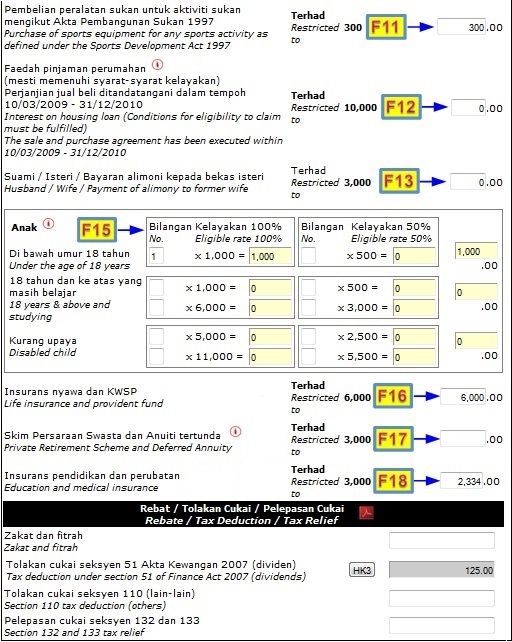

Borang ea section f. Lain lain elaun perkuisit pemberian manfaat yang dikecualikan cukai tetapi tidak perlu dilaporkan dalam bahagian f borang ea adalah seperti berikut. An easy way to know whether you need to pay up is to take a look at the ea form your hr department would give you. C failure to prepare and render form ea ec to employees on or before 29 february 2020 is an offence under paragraph 120 1 b of ita 1967. Makanya aku terus masuk laman web e filling macam biasa.

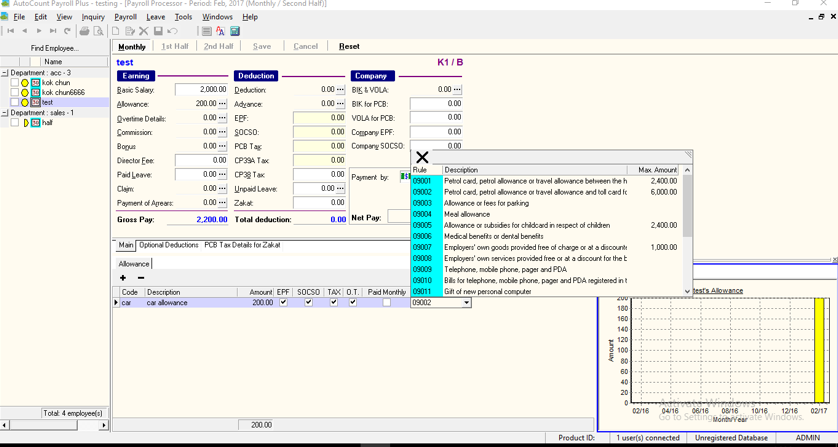

Forms ea and ec in excel and pdf format can also be obtained in another section of the lhdnm official. Ok untuk sesiapa yang dah tahu ni cukai pendapatan die boleh la buat permohonan no pin kat ez hasil gov my ni. Kelulusan bagi menggunakan borang ea borang ec dan format c p. In the latest revised ea form for tax assessment year 2008 borang c p 8a pin 2008 there are 2 columns for filing your allowances perquisites gifts benefits provided to you by your employer.

Only tax exempt allowances perquisites gifts benefits listed above no. Penyata gaji pekerja swasta ea. B complete all relevant items in block letters and use black ink pen. Look at the total section.

Kindly note that minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e and cp8d to irb as well as prepare and deliver form ea to the employees. Borang ea ini perlu disediakan untuk diserahkan kepada pekerja. Notes for part f of form ea. Dilaporkan dalam bahagian f borang ea.

If it shows rm34 000 and above then it s time for you to start settling your dues. I barangan yang merupakan produk boleh guna perniagaan majikan yang diberi secara percuma diskaun penuh atau diberi. List of tax exempt allowances perquisites gifts benefits which are required to declare. What if you fail to submit borang e and cp8d.

8d versi lama bagi tahun saraan 2016 sahaja approval for the use of old version of form ea form ec and c p. Notes for part f of form ea. List of tax exempt allowances perquisites gifts benefits which are required to declare. 1 to 8 are required to declare in part f of form ea.

Only tax exempt allowances perquisites gifts benefits listed above no. Aku pernah buat tahun lepas jadi aku dah tak payah buat tahun ni. Failure to do so will result in the irb taking legal action against the company s director. A refer to the explanatory notes before filling up this form.