Borang Ea Income Tax

Fix borang ea ec batch email subject is empty replace rhb reflex excel file format salary epf and socso with text file format adjust calculation for number of child qualified for tax relief in income tax ea ec and cp8d report for year 201 version 17 june 2017 personal loan application form borang permohonan pinjaman peribadi page 1 of 9 name as in nric or passport nama seperti.

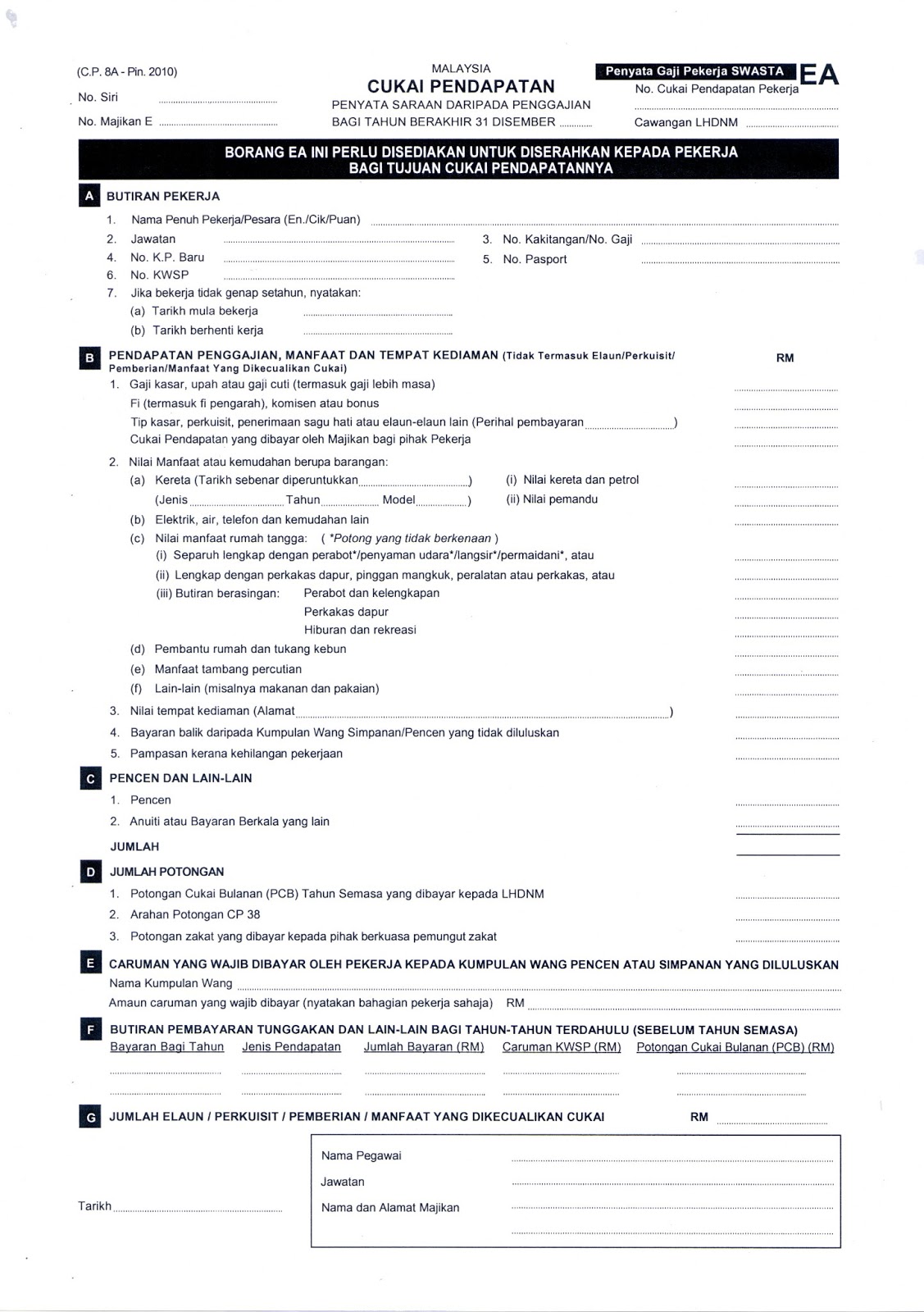

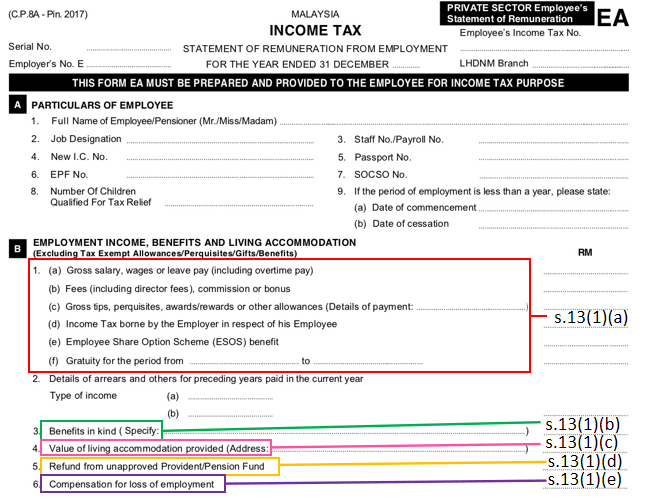

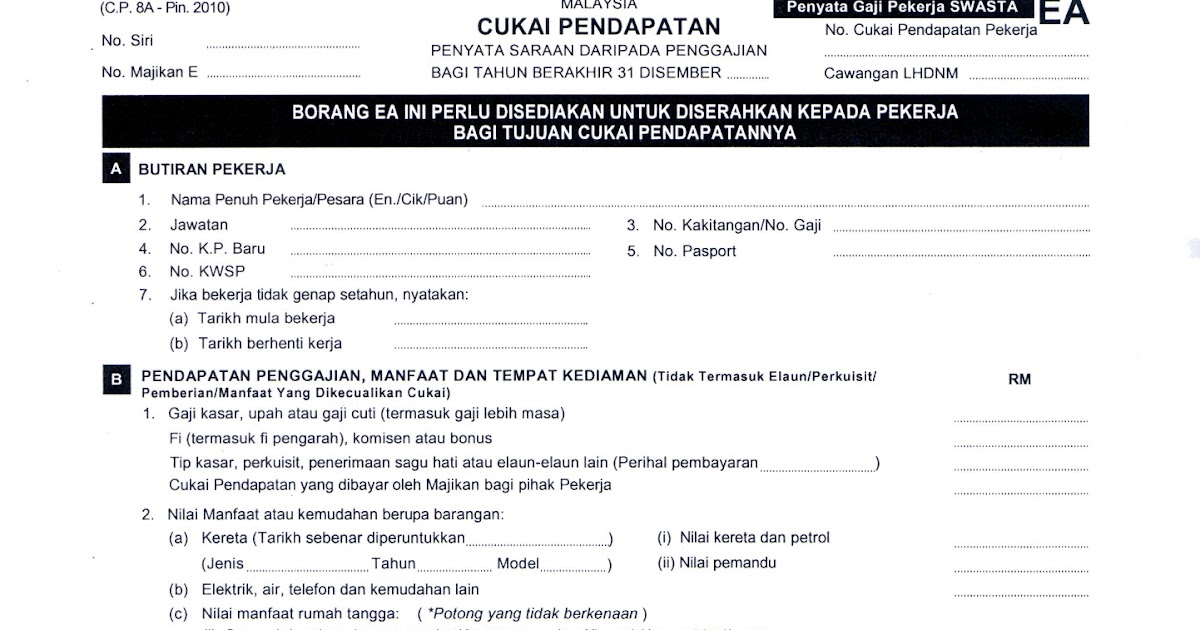

Borang ea income tax. Jika anda ada melantik agen cukai untuk menguruskan dan mengisi borang income tax borang ea masih juga diperlukan. Borang cukai hendaklah dihantar selewatnya 30 april dan jika lambat penalti akan dikenakan. Ea this form ea must be prepared and provided to the employee for income tax purpose employment income benefits and living accommodation excluding tax exempt. According to the inland revenue board of malaysia an ea form malaysia also refer to borang ea ea statement ea employee is an annual remuneration statement that every employer shall prepare and render to his employee statement of remuneration of that employee before 1st march in the year immediately following the first mentioned year.

You will usually use this form to file personal taxes. In the exercise of authority conferred under section 74 of the income tax act 1967 declare that. Cukai pendapatan pekerja cawangan lhdnm. Every employer shall for each year prepare and render to his employee a statement of remuneration of that employee c p 8a ea and c p 8c ec form on or before the last day of february in the year immediately following the first mentioned year in order for each employee to fill and submit return form in accordance to subsection 83 1a income tax act 1967 act.

Above rm 2 800 better to declare since your boss would probably file you in the borang e for their company. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. Saya diberi kuasa untuk mewakili pihak pembayar cukai harta pusaka bagi mengemukakan borang yang ditentukan secara elektronik given the authority to represent the tax payer deceased person s estate to furnish any prescribed forms. Ea form borang c p 8a overview in accordance with subsection 83 1a of the income tax act 1967 ita 1967 the form c p 8a c p 8c must be prepared and rendered to the employees on or before end of february the following year to enable them to complete and submit their respective return form within the stipulated period.

Pcb will offset the total amount of tax payable in your income tax computation much later. Penyata gaji pekerja swasta ea no.