Borang E Submission Due Date 2019

E 2019 employer 31 march 2020 be 2019 resident individual who does not carry on any business 30 april 2020 b 2019 resident individual who carries on business 30 june 2020 p 2019 partnership bt 2019 resident individual knowledge worker expert worker 30 april 2020 does not carry on any.

Borang e submission due date 2019. According to lembaga hasil dalam negeri lhdn the move is meant to facilitate the submission of tax returns affected by the national movement control order which starts today. Borang e is an employer s annual return of remuneration for every calendar year and due for submission by 31st march of the following calendar year. 31 july 2019 until 31 august 2019 ree 3 months grace period from the due date of submission is allowed for those with accounting period ending 1 september 2019 until 31 december 2019. Thus the new deadline for filing your income tax returns in malaysia via e filing is 30 june 2020 for resident individuals who do not carry on a business and 30 august 2020 for resident individuals who carry on a.

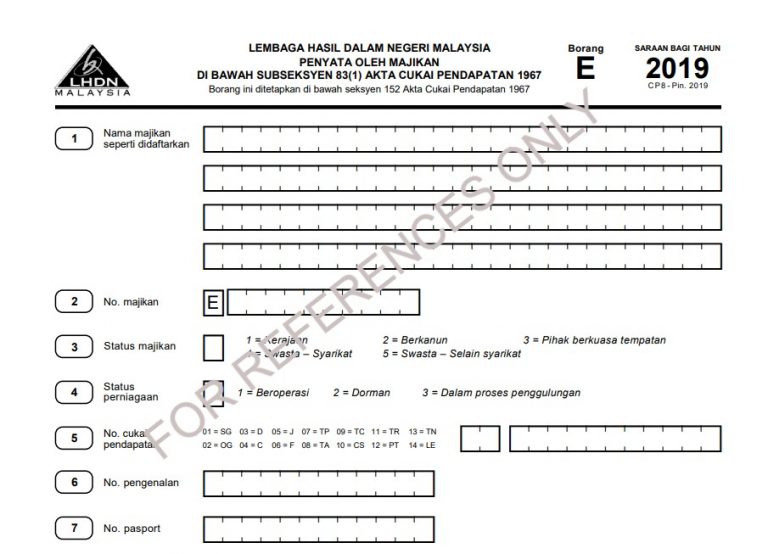

According to the income tax act 1967 akta 53. Carian maklumat tarikh penghantaran borang cukai pendapatan secara manual dan efiling untuk tahun taksiran 2019 beserta tambahan masa. Every employer shall for each year furnish to the director general a return in the prescribed form. Nama 5 7 negeri no.

E submission of certificate of residence cor for withholding tax. 1 2019 cp8. Untuk makluman pengemukaan borang nyata cukai pendapatan bncp lembaga hasil dalam negeri malaysia untuk tahun taksiran 2019melalui e filling bagi borang e be b bt p mt dan tf boleh dilakukan pada tarikh yang dinyatakan dibawah. Tarikh akhir penghantaran borang cukai e filing 2020 taksiran tahun 2019.

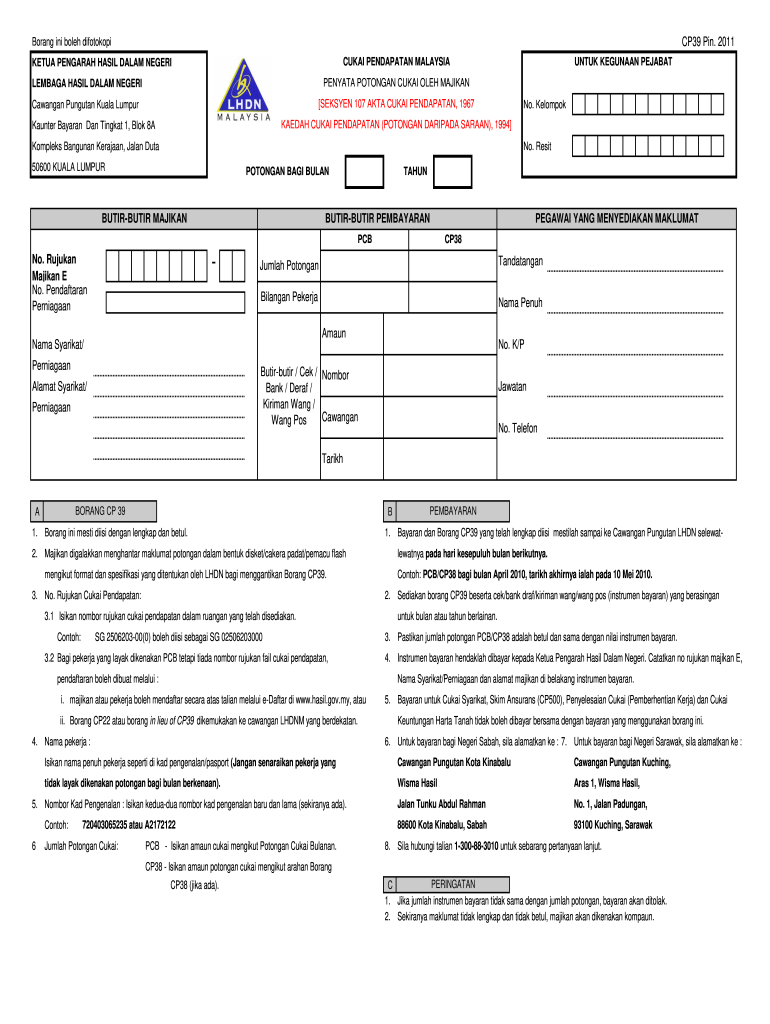

File gst return 1 jan 31. Form e borang e is required to be submitted by every employer company enterprise partnership to lhdn inland revenue board irb every year not later than 31 march. File estimated chargeable income eci dec year end 31 mar 2020. Enforcement action may be taken against employers who fail to pay by the 14th of the following month or the next working day if the 14th falls on a saturday sunday or public holiday.

E submission of employment income. 2019 borang saraan bag i tahun e lembaga hasil dalam negeri malaysia penyata oleh majikan cukai pendapatan 1967 borang ini ditetapkan di bawah seksyen 152 akta cukai pendapatan 1967 tarikh terima 1 tarikh terima 2 untuk kegunaan pejabat e. Form type category due date for submission.