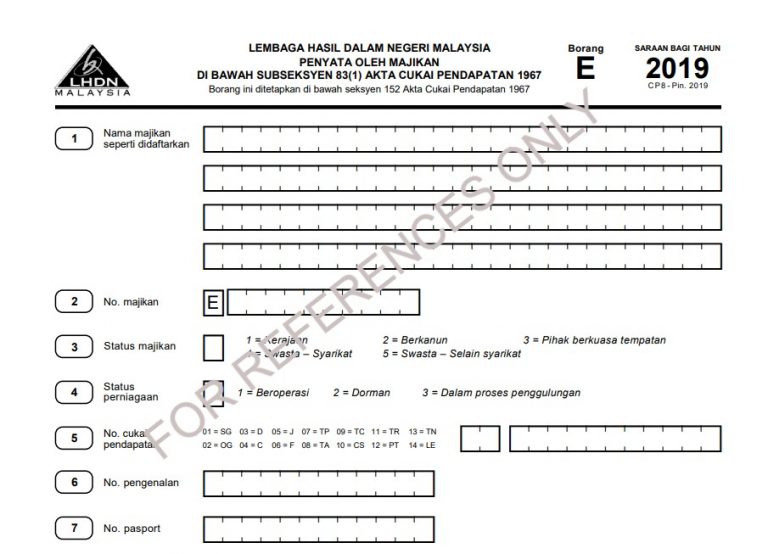

Borang E Is What

En borang e workshop kl what is a form e.

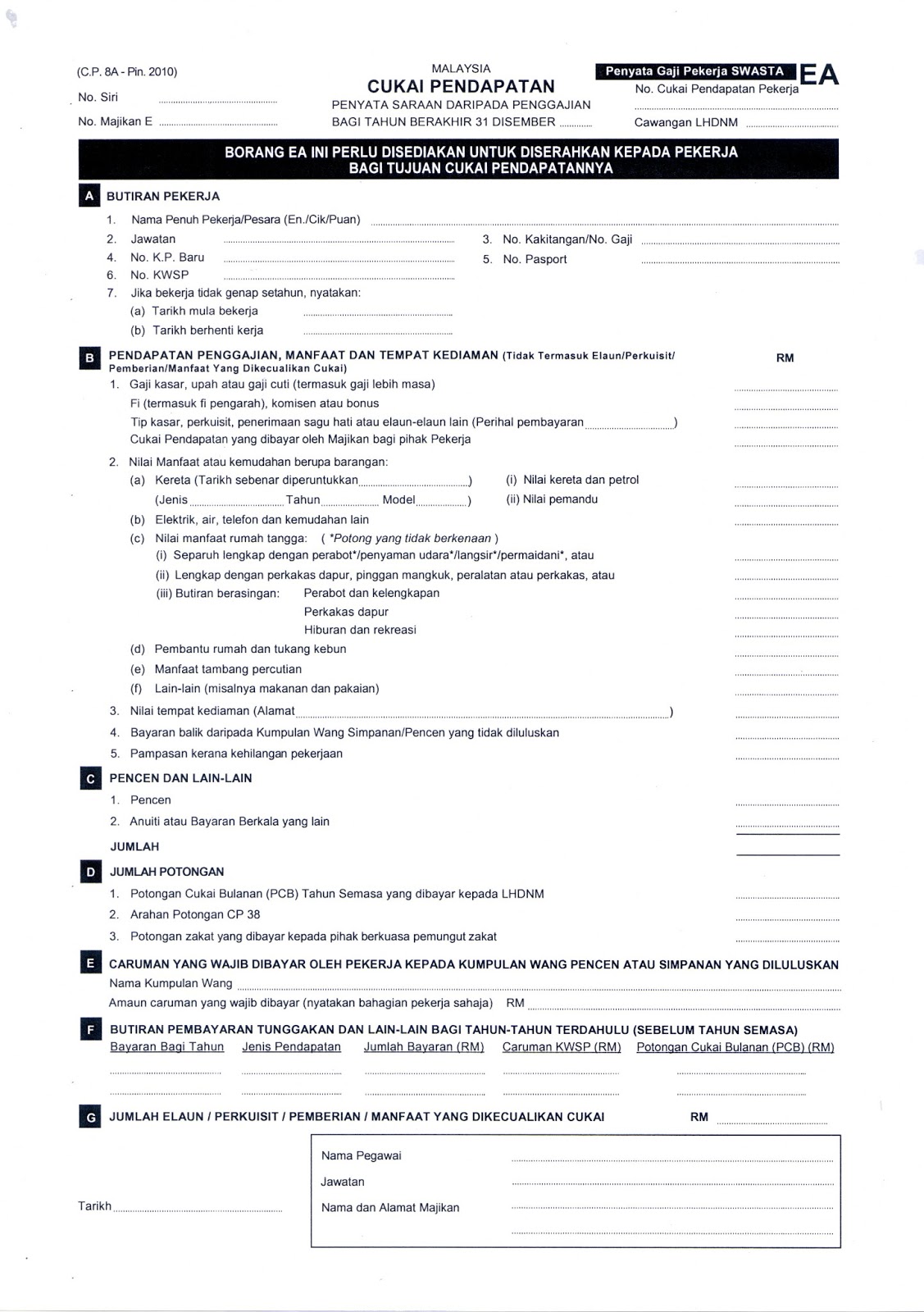

Borang e is what. Form e borang e is required to be submitted by every employer company enterprise partnership to lhdn inland revenue board irb every year not later than 31 march. Details for all employees remuneration matters to be included in the cp8d. All employers sdn bhd berhad sole proprietor partnership are mandatory to submit employer return form also known as borang e e form via e filing for the year of remuneration 2019 in accordance with subsection 83 1b of the income tax act ita 1967. Borang e is an employer s annual return of remuneration for every calendar year and due for submission by 31st march of the following calendar year.

To use e filing for the first time you need to get pin number first. Basically its a form of declaration report to inform the irb on the number of employees and the list of employee s income details and must be submitted by 31st march of each calendar year. Every employer shall for each year furnish to the director general a return in the prescribed form. ð isikan 0 di bahagian a dan bahagian b borang e 2010.

Apakah layanan pengemukaan borang e bagi syarikat perkongsian. Isikan 0 di bahagian a dan bahagian b borang e. Form e is a declaration report submitted by every employer to inform the irb on the number of employees and the list of employee s income details every year not later than 31st march. ð borang e yang diterima itu perlu dilengkapkan dan ditandatangani.

Employers may still submit form e manually to irb this year for year of assessment 2015 submission. Form e borang e is a form required to be fill and submit to inland revenue board of malaysia ibrm by an employer. Borang e yang diterima itu perlu dilengkapkan dan ditandatangani. Go to the nearest irbm branch.

On and before 30 4 2020. You can do so by. Majikan yang aklumat melalui e data praisi tidak perlu mengemukakan borang c p 8d. What is borang e form e.

ð menghantar surat makluman ke cawangan di mana fail majikan berada untuk tindakan supaya borang e tidak lagi dikeluarkan pada masa akan datang sehinggalah syarikat tersebut beroperasi semula. Send email to pin hasil gov my and please attach copy of identity card front and back or passport. B kegagalan mengemukakan borang e pada atau sebelum 31 mac 2019 adalah menjadi satu kesalahan di bawah. 31 mac 2019 a borang e hanya akan dianggap lengkap jika c p 8d dikemukakan pada atau sebelum 31 mac 2019.

1 tarikh akhir pengemukaan borang. The e filing steps will be enclosed together with the pin number. According to the income tax act 1967 akta 53.