Borang E And Ea

Pastinya bulan ni majikan sudah edarkan borang ea ec masing masing.

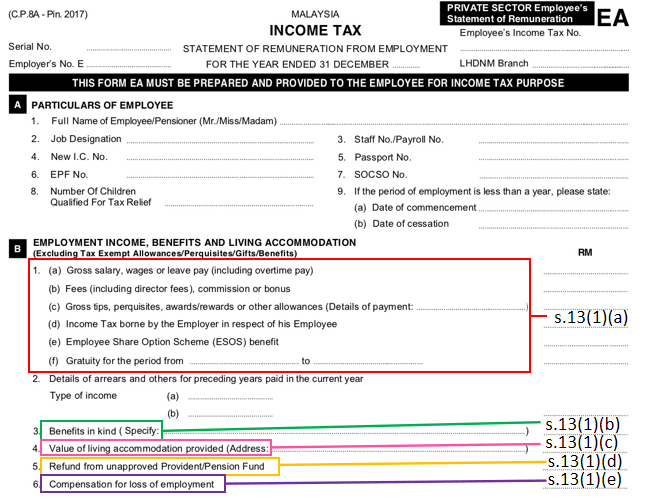

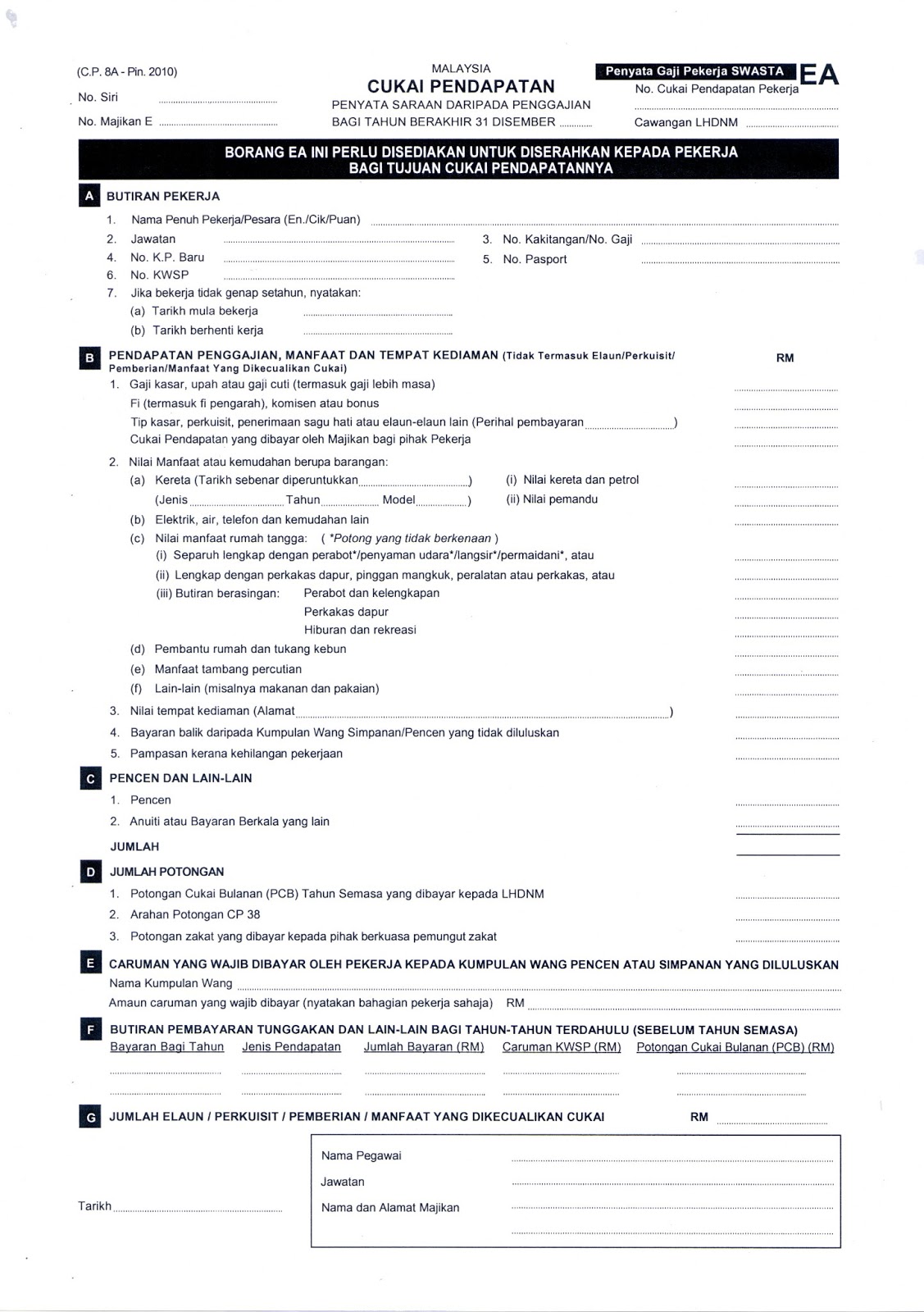

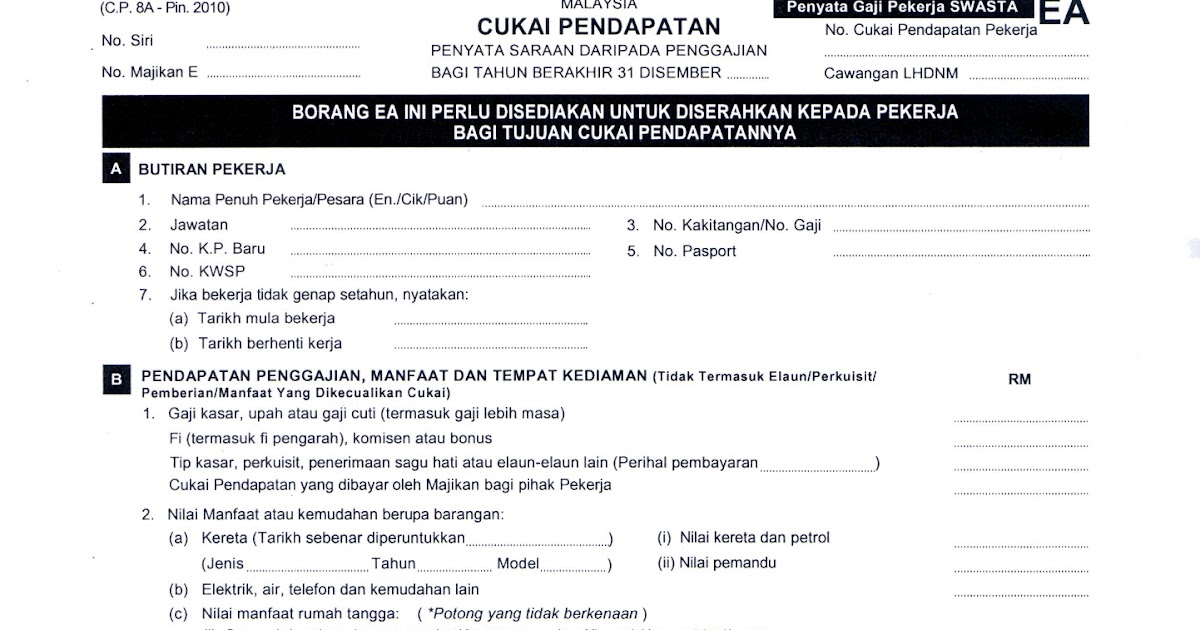

Borang e and ea. Anggaran cukai yang kena dibayar oleh syarikat perkongsian liabiliti terhad koperasi badan amanah. Failure to do so will result in the irb taking legal action against the company s director. It s time to prepare borang ea form ea or c p 8a borang e form e or c p 8d for your employees. Bagaimana pula rujuk borang ea bahagian b 1 b c.

Bahagian ini ada yg nak kena isi dalam e borang jugak ke. Company owners employees who responsible to complete and submit borang e ea. Nota panduan borang ea ec. Tax season is here.

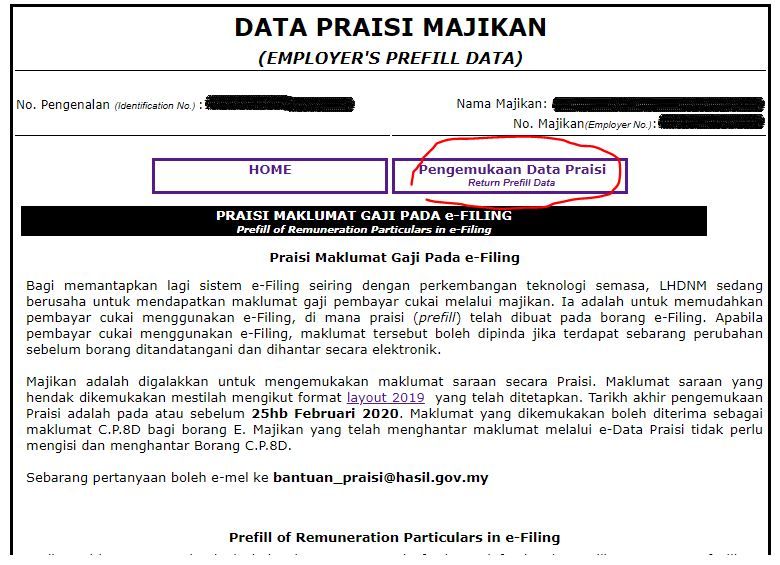

Be aware of penalties for late submission. To educate business owners on how to fill up borang e ea. Mulai tahun taksiran 2018 syarikat hendaklah mengemukakan anggaran cukai secara elektronik kepada lembaga hasil dalam negeri malaysia. Lhdn borang ea ea form malaysia according to the inland revenue board of malaysia an ea form malaysia also refer to borang ea ea statement ea employee is an annual remuneration statement that every employer shall prepare and render to his employee statement of remuneration of that employee before 1st march in the year immediately following the first mentioned year.

Aklumat melalui e data praisi tidak perlu mengemukakan borang c p 8d. Borang ea borang ec bajet 2009 zakat cukai pendapatan e filing e hasil gov my. To generate past years payroll record and tax forms such as borang ea form ea or c p. 8a borang e form e or c p.

Be aware of dateline submission for borang e ea. Jadi kalau dah terima borang ea ec bolehla e filing. Cukai dihujung jari anda. Merujuk e borang ada bahagian untuk pendapatan berkanun faedah diskaun royalti premium pencen anuiti bayaran berkala lain dan apa apa perolehan atau keuntungan lain yang ni apa maksudnya pula.

Borang cp204 cp204a dan cp204b. So what if you fail to submit borang e. What if you fail to submit borang e and cp8d. Kindly note that minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e and cp8d to irb as well as prepare and deliver form ea to the employees.

Failure in submitting borang e will result in the irb taking legal action against the company s directors. To walk through all the documents that needed to be prepared by business owners. Talenox offers a convenient way for companies in malaysia to import their employee data. C kegagalan menyedia dan menyerahkan borang ea ec kepada pekerja pada atau sebelum 28 februari 2019 adalah.

B kegagalan mengemukakan borang e pada atau sebelum 31 mac 2019 adalah menjadi satu kesalahan di bawah perenggan 120 1 b akta cukai pendapatan 1967 acp 1967.