Borang E 2019 Extension

Group agents must enter the special identification number assigned to the partnership i e group id 80081xxxx in the full.

Borang e 2019 extension. Mulai 18 mac 2019 lembaga hasil dalam negeri malaysia lhdnm tidak lagi menerima permohonan untuk sijil taraf orang kena cukai stokc. Form it 201 resident income tax return form it 203 nonresident and part year resident income tax return form it 203 gr group return for nonresident partners note. E permohonan pindaan be adalah permohonan pindaan atas kesilapan atau khilaf bagi borang nyata cukai pendapatan yang telah dikemukakan secara e filing atau m filing dalam tempoh semakan pengesahan semakan semula pengesahan penerimaan borang yang telah dihantar secara e filing. Individuals partnerships form be resident individuals who do.

How to register a business in malaysia with ssm 5 steps 2019. Kindly note that minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e and cp8d to irb as well as prepare and deliver form ea to the employees. See screenshots read the latest customer reviews and compare ratings for raw image extension. Bahawa pembayar cukai yang pertama kali melaporkan pendapatan menyamai atau melebihi rm 450 000 melalui hantaran borang secara e filing perlu memohon tac.

How to file income tax in malaysia using e filing mr stingy. Download this app from microsoft store for windows 10 windows 10 team surface hub hololens. If you cannot file on time you can request an automatic extension of time to file the following forms. How to generate e form c p 8d.

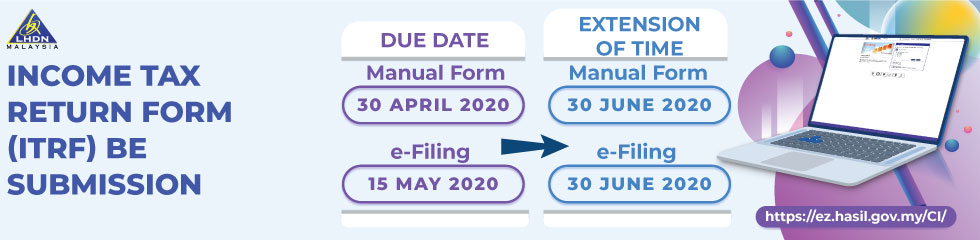

Form e employers ya 2019 31 march 2020 31 may 2020 b. Tarikh akhir e filling 2020 lhdn perhatian buat pembayar cukai bila tarikh akhir hantar borang cukai efilling 2020 untuk tahun taksiran 2019. What if you fail to submit borang e and cp8d. Members are informed that the inland revenue board irb has granted an extension of time to august 14 2003 for the submission of borang c and borang r for year of assessment 2002 in respect of companies whose accounting year ended on december 31 2002.

E 2019 employer 31 march 2020 be 2019 resident individual who does not carry on any business 30 april 2020 b 2019 resident individual who carries on business 30 june 2020 p 2019 partnership bt 2019 resident individual knowledge worker expert worker 30. Borang c and borang r must be received by the irb on or before august 14 2003. How to get ea e form done. Failure to do so will result in the irb taking legal action against the company s director.

Untuk makluman pengemukaan borang nyata cukai pendapatan bncp lembaga hasil dalam negeri malaysia untuk tahun taksiran 2019melalui e filling bagi borang e be b bt p mt dan tf boleh dilakukan pada tarikh yang dinyatakan dibawah.