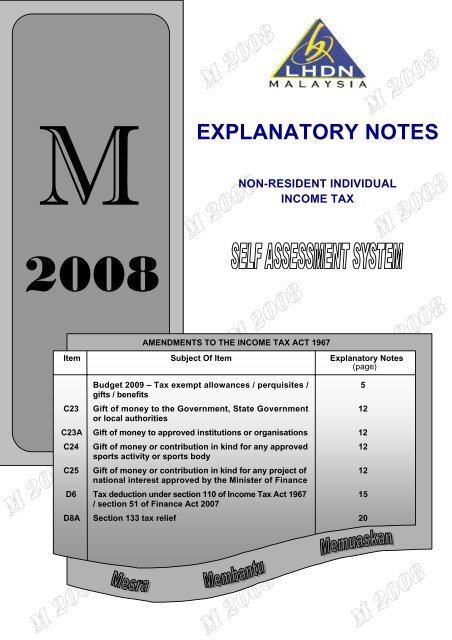

Borang E 2019 Explanatory Notes

Norwani baharum created date.

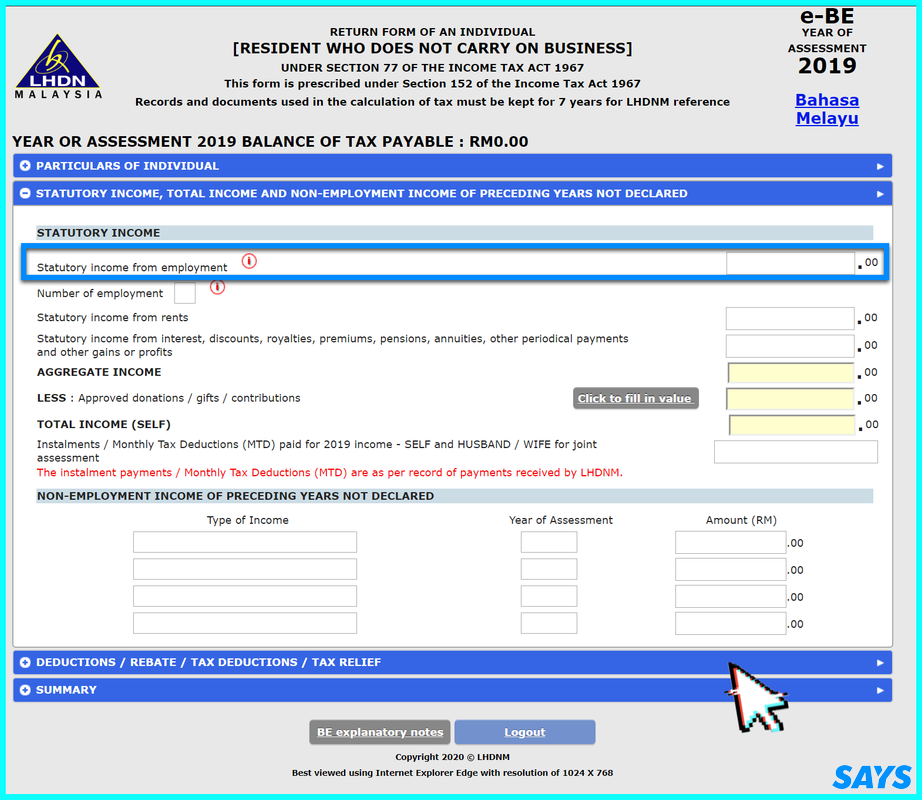

Borang e 2019 explanatory notes. The country code provided on page 25 of this explanatory notes or appendix e. Form e will only be considered complete if c p 8d is submitted on or. A3 gender enter 1 for male or 2 for female. Section e remuneration 2019.

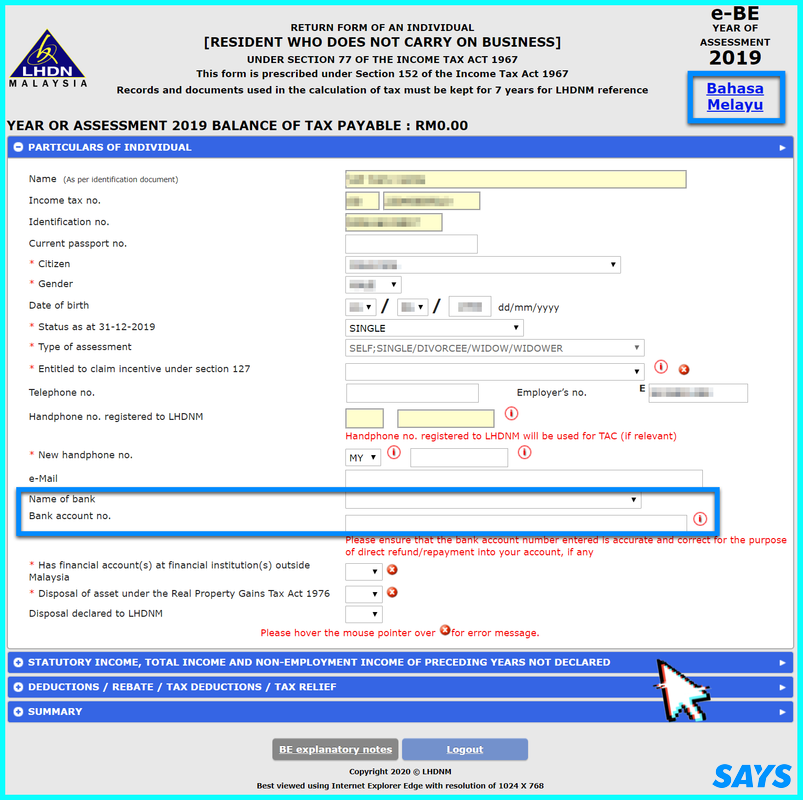

The country code provided on page 21 of this explanatory notes or appendix e. Aplikasi e filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar borang nyata cukai pendapatan bncp dan borang anggaran secara online. Mulai 18 mac 2019 lembaga hasil dalam negeri malaysia lhdnm tidak lagi menerima permohonan untuk sijil taraf orang kena cukai stokc. A4 status as at 31 12 2019 enter 1 for single.

Due date to furnish form e for the year of remuneration 2019 is 31 march 2020. Bahawa pembayar cukai yang pertama kali melaporkan pendapatan menyamai atau melebihi rm 450 000 melalui hantaran borang secara e filing perlu memohon tac. Not all sections and items may be applicable to your company. Nota penerangan be 2019 untuk mengisi borang be cukai pendapatan tahun 2019.

Explanatory notes to form c for year of assessment ya 2019 irin 300 page 2 e download these forms from iras website under home quick links forms businesses corporate tax forms failure to submit the form and the requisite documents will lead to a disqualification of the company s claim where applicable. 414 2019 which takes effect from the year of assessment 2019 until the year of assessment 2021. Section d profile of employment 2019. Annual industry survey ais note.

3 for divorcee widow widower or 4 for deceased. Pembayar cukai dan majikan adalah digalakkan mengguna e filing untuk mengemukakan borang nyata cukai pendapatan bncp yang mempunyai. Explanatory notes on vat e commerce rules council directive eu 2017 2455 council directive eu 2019 1995 council implementing regulation eu 2019 2026 disclaimer. These explanatory notes are not legally binding and only contain practical and informal guidance about how eu law should be applied on the basis of the views of the commission s.

E survey guide and settings survey faqs survey explanatory notes. For the item income tax no enter sg or og followed by the income. Other than malaysia refer to page 21 of this notes or the full list in appendix e for the relevant country code. Explanatory notes b 2019 resident individual business 1 basic particulars 1 4 fill in relevant information only.