Borang Be 2019 Tax Rate

Working holiday maker tax rates 2019 20.

Borang be 2019 tax rate. Program memfail borang nyata bn bagi tahun 2019 pindaan 4 2019 contoh format baucar dividen. 56 075 plus 45c for each 1 over 180 000. Tax relief for year of assessment 2019 tax filed in 2020 chapter 5. What is income tax return.

Income tax brackets and rates. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 510 300 and higher for single filers and 612 350 and higher for married couples filing jointly. Notice that new tax brackets and the corresponding income thresholds go into effect for the 2019 tax year. Use the 2018 tax rates when you file taxes in april 2019.

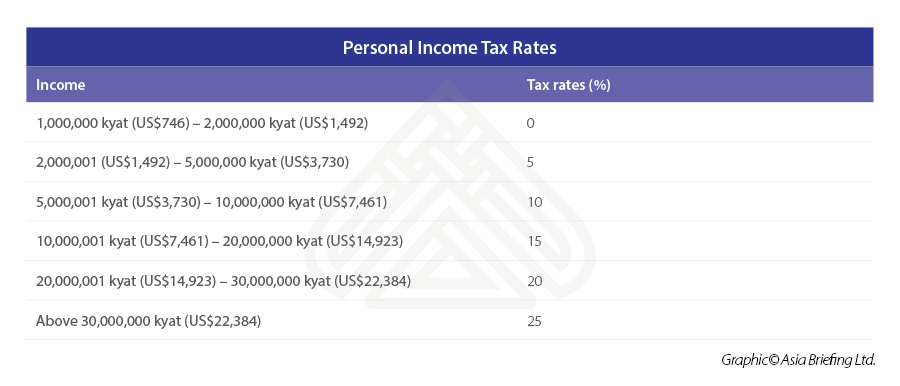

10 15 25 28 33 35 and 39 6. Tax administration diagnostic assessment tool tadat association of tax authorities in islamic countries. For ya 2019 a personal tax rebate of 50 of tax payable up to maximum of 200 is granted to tax residents. Pengiraan rm kadar cukai rm 0 5 000.

15c for each 1. In 2019 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1. 22 775 plus 37c for each 1 over 90 000. Borang be untuk individu yang hanya ada pendapatan penggajian sahaja.

Sebenarnya borang be b 2020 akan dimuat naik pada 1 mac. 5 550 plus 32 5c for each 1 over 37 000. How does monthly tax deduction mtd pcb work in malaysia. The deadline for filing income tax in malaysia is 30 april 2019 for manual filing and 15 may 2019 via e filing.

Program memfail borang nyata bn bagi tahun 2020. Borang be 2019 borang b 2019 borang be 2018 borang b 2018. From ya 2017 the tax rates for non resident individuals except certain reduced final withholding tax rates has been raised from 20 to 22. The brackets before the tax reform were.

Program memfail borang nyata bn bagi tahun 2020. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. Tax administration diagnostic assessment tool tadat. You can file your taxes on ezhasil on the lhdn website.

You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Program memfail borang nyata bn. Tax rates for year of assessment 2019 tax filed in 2020 chapter 6. Anda nak tengok borang be b 2020.

Registering as a first time taxpayer on e daftar. Apa beza borang be dan borang b. Malaysia income tax e filing guide. Tahun taksiran 2018 2019.

For ya 2017 a. Cukai pendapatan kesejahteraan. How to pay income.